Are you taking a risk or putting yourself at risk? They’re very different things on the risk spectrum.

Entrepreneurs love to view risk as binary. The more you put on the line, the greater the potential for reward. Go on, take that second mortgage so you can pour more cash into your business. Mine your life savings for a few more months of runway. The thrill, the adrenaline, the glory come from being at the precipice of either winning or losing it all.

That’s a terrible way to navigate your company. It’s misguided, toxic, and, unfortunately, all too common. It’s what happens when the notion of risk is distorted — compressed from a spectrum to a single, indivisible point.

The reality is, risk is variable. Those in the financial world know it. They define it in terms of beta. A beta of 1 tracks the market. If a stock’s beta is 1.3, then it’s theoretically 30 percent more volatile than the market as a whole. If it’s 0.6, then it’s 40 percent less volatile. You can take on a little more risk, moving your beta up, without having to go all in.

But when you run in entrepreneurial circles, attend entrepreneurial conferences, and read the entrepreneurial press, you rarely see risk portrayed as something that’s incremental. It’s winner takes all! Take the risk, reap the reward!

I’ve never looked at risk that way. I’m generally risk averse, and most great entrepreneurs I know are as well. We take risks occasionally, but we rarely bet the farm on something unless there’s no other choice. We ease in, we don’t rush in. I’ll admit it now: I’m an entrepreneur, and I don’t like big risks.

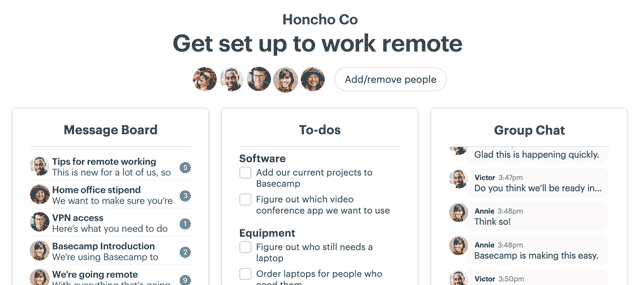

At Basecamp, we take comfortable risks all the time. This means trying something new without fear. Taking a leap, but knowing that if it doesn’t work, no one’s going to miss a meal over it.

For example, we’re currently working on something that from the outside appears incredibly risky: We’re about to triple the price of one of our offerings.

We’re making some significant improvements to the product at the same time. And the new price won’t apply to everyone — existing Basecamp customers will be grandfathered in at their current prices. But new customers signing up for Basecamp will see the new prices.

Now, ask your fellow entrepreneurs if they think tripling prices is risky. I bet they say yes. Or more specifically: “Are you crazy?”

In reality, we’re boringly sane.

Did we test it? No. Did we ask people if they’d be willing to pay more? No. Are we sure it’ll work? Absolutely not. Sounds risky!

But I don’t think those are actually the right questions. Better to ask: Will we go out of business if it doesn’t work? No. Will the business be materially affected if people won’t pay more for Basecamp? No. Will we have to lay people off if this wild experiment falls flat? No. Why not? Because we already have a massive base of over 100,000 customers paying us what they were before.

We’ll give it six months and see how it turns out. We’ll tweak along the way. A big step first, and then small steps as we go. And we can always walk it back if we need to. That’s managed, calculated risk.

The next time you decide to make what seems like a radical change, don’t fool yourself into believing you’re being brave and bold. Instead, ask yourself the right questions. Figure out where the bet falls on the risk spectrum, along with the consequences if it doesn’t work out. Then you’ll know whether to take that leap.

This article appears in the October issue of Inc. Magazine.