About 12 years ago, I co-founded a startup called Basecamp: A simple project collaboration tool that helps people make progress together, sold on a monthly subscription.

It took a part of some people’s work life and made it a little better. A little nicer than trying to manage a project over email or by stringing together a bunch of separate chat, file sharing, and task systems. Along the way it made for a comfortable business to own for my partner and me, and a great place to work for our employees.

That’s it.

It didn’t disrupt anything. It didn’t add any new members to the three-comma club. It was never a unicorn. Even worse: There are still, after all these years, less than fifty people working at Basecamp. We don’t even have a San Francisco satellite office!

I know what you’re thinking, right? BOOOORING. Why am I even listening to this guy? Isn’t this supposed to be a conference for the winners of game startup? Like people who’ve either already taken hundreds of million in venture capital or at least are aspiring to? Who the hell in their right mind would waste more than a decade toiling away at a company that doesn’t even have a pretense of an ambition for Eating The World™.

Well, the reason I’m here is to remind you that maybe, just maybe, you too have a nagging, gagging sense that the current atmosphere of disrupt-o-mania isn’t the only air a startup can breathe. That perhaps this zeal for disruption is not only crowding out other motives for doing a startup, but also can be downright poisonous for everyone here and the rest of the world.

Part of the problem seems to be that nobody these days is content to merely put their dent in the universe. No, they have to fucking own the universe. It’s not enough to be in the market, they have to dominate it. It’s not enough to serve customers, they have to capture them.

In fact, it’s hard to carry on a conversation with most startup people these days without getting inundated with odes to network effects and the valiance of deferring “monetization” until you find something everyone in the whole damn world wants to fixate their eyeballs on.

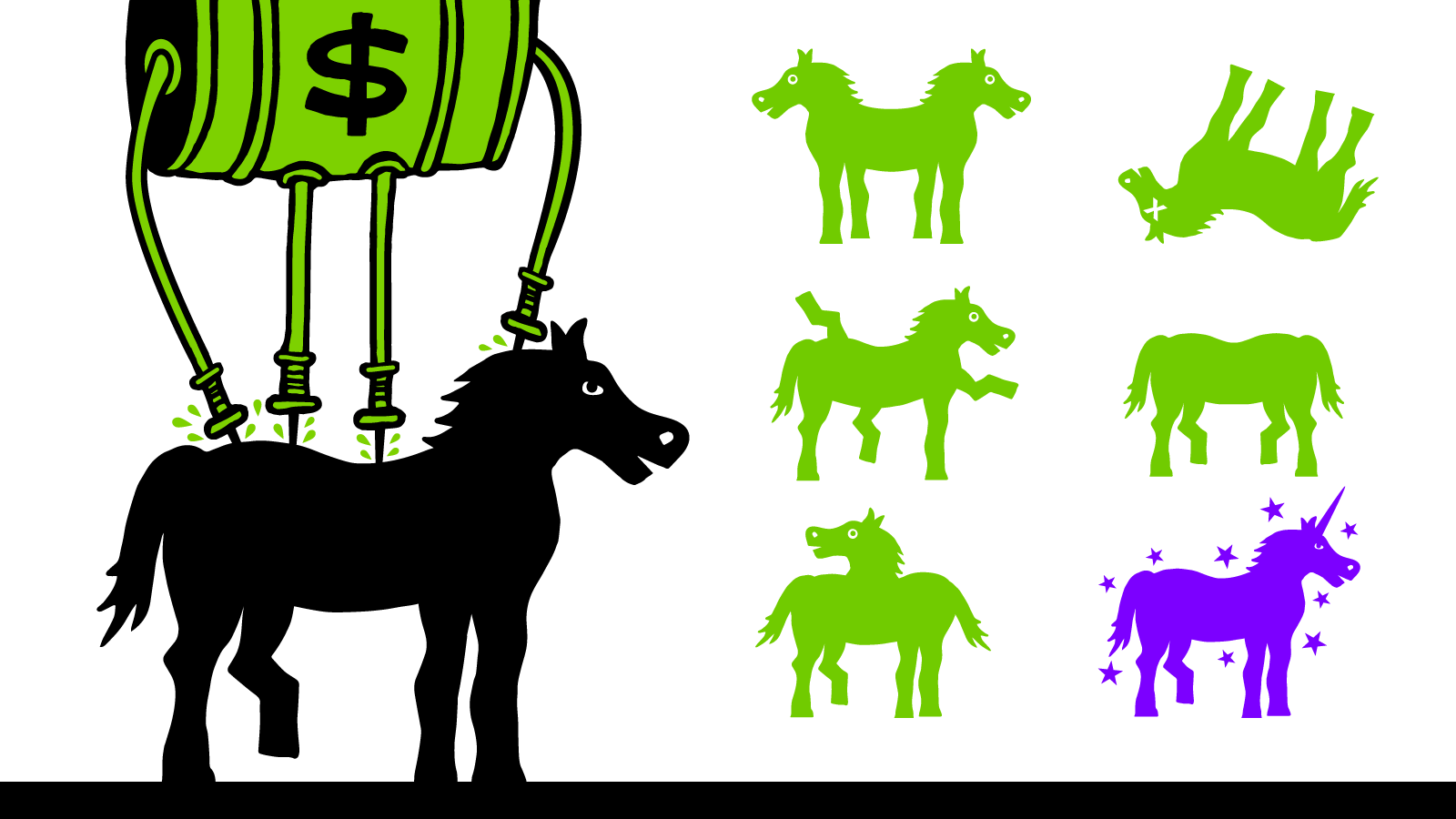

In this atmosphere, the term startup has been narrowed to describe the pursuit of total business domination. It’s turned into an obsession with unicorns and the properties of their “success”. A whole generation of people working with and for the internet enthralled by the prospect of being transformed into a mythical creature.

But who can blame them? This set of fairytale ideals are being reinforced at every turn.

Let’s start at the bottom: People who make lots of little bets on many potential unicorns have christened themselves angels. Angels? Really? You’ve plucked your self-serving moniker from the parables of a religion that specifically and explicitly had its head honcho throw the money men out of the temple and proclaim a rich man less likely to make it into heaven than a camel through a needle’s eye. Okay then!

“It is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God” — Matthew 19:23–26

And that’s just the first step of the pipeline. If you’re capable of stringing enough buzzwords about disruption and sufficient admiration for its holy verses, like software eating the world, and an appropriate yearning for the San Franciscan Mecca, you too can get to advance in this multi-level investment scheme.

Angels are merely the entry level in the holy trinity of startup money. Proceed along the illuminated path and you’ll quickly be granted an audience with the wise venture capitalists. And finally, if your hockey stick is strong, you’ll get to audition in front of the investment bankers who will weigh your ability to look shiny just long enough until the lock-up period on insiders selling shares is up.

And guess what these people call that final affirmation: A LIQUIDITY EVENT. The baptizing required to enter financial heaven. Subtle, isn’t it? Oh, and then, once you’ve Made It™, you get to be reborn an angel and the circle of divinity is complete. Hale-fucking-lujah!

You might think, dude, what do I care? I AM SPECIAL. I’m going to beat all the odds of the unicorn sausage factory and come out with my special horn. And who gives a shit about the evangelical vocabulary of financiers anyway? As long as they show me the money, I’ll call them Big Dollar Daddy if they want to. No skin off my back!

So first you take a lot of money from angels desperate to not miss out on the next big unicorn. Then you take an obscene amount of money from VCs to inflate your top-line growth, to entice the investment bankers that you might be worthy of foisting upon the public markets, eventually, or a suitable tech behemoth.

And every step along this scripted way will you accumulate more bosses. More people with “guidance” for you, about how you can juice the numbers long enough to make it someone else’s problem to keep the air castle in the sky inflated and rising. But of course it isn’t just guidance, once you take the money. It’s a debt owed, with all the nagging reciprocity that comes with it.

Now, if you truly want to become the next fifty-billion dollar Uber in another five years, I guess this game somehow makes sense in its own twisted logic. But it’s more than worth a few moments of your time to reconsider whether that’s really what you want. Or, even more accurately, whether an incredibly unlikely shot at that is what you want.

Don’t just accept this definition of “success” because that’s what everyone is cheering for at the moment. Yes, the chorus is loud, and that’s seductively alluring, but you don’t have to peel much lacquer off the surface to see that wood beneath might not be as strong as you’d imagine.

Let’s take a step back and examine how narrow this notion of success is.

First, ponder the question: Why are you here?

“Get Your Ticket To Join The World’s Largest Companies and Most Exciting Startups: It’s not just startups that come to Web Summit. Senior executives from the world’s leading companies will be joining to find out what the future holds and to meet the startups that are changing their industries.” — Web Summit invitation.

That’s one reason: You think you’d like to be mentioned in that headline: The World’s Largest Companies and Most Exciting Startups. In other words, you too would really like to try that unicorn horn out for size. And white, white, is totally your color. It’s meant to be.

Well, to then answer the question, “why are you here?”, you might as well make it literal. Why are you HERE. Dublin, Ireland, The European Union? Don’t you know that surely the fastest and probably the only way to join the uniclub is to rent a mattress in the shifty part of San Francisco where the rent is only $4,000/month?

Because while that area north of Silicon Valley is busy disrupting everything, it still hasn’t caught up with the basic disruption of geography. So if your angel or VC can’t drop by your overpriced office for a jam session, well, then you’re no good at all, are you?

The real question is why do you startup? I don’t actually believe that most people are solely motivated by fawning over the latest hockey stick phenomenon. Bedazzled, probably, but not solely motivated. I invite you to dig deeper and explore those motivations. As inspiration, here were some of mine when I got involved with Basecamp:

I wanted to work for myself. Walk to my own beat. Chart my own path. Call it like I saw it, and not worry about what dudes in suits thought of that. All the cliches of independence that sound so quaint until you have a board meeting questioning why you aren’t raising more, burning faster, and growing at supersonic speeds yesterday?!

Independence isn’t missed until it’s gone. And when it’s gone, in the sense of having money masters dictate YOUR INCREDIBLE JOURNEY, it’s gone in the vast majority of cases. Once the train is going choo-choo there’s no stopping, no getting off, until you either crash into the mountain side or reach the IPO station at lake liquidity.

I wanted to make a product and sell it directly to people who’d care about its quality. There’s an incredible connection possible when you align your financial motivations with the service of your users. It’s an entirely different category of work than if you’re simply trying to capture eyeballs and sell their attention, privacy, and dignity in bulk to the highest bidder.

I’m going to pull out another trite saying here: It feels like honest work. Simple, honest work. I make a good product, you pay me good money for it. We don’t even need big words like monetization strategy to describe that transaction because it is so plain and simple even my three year-old son can understand it.

I wanted to put down roots. Long term bonds with coworkers and customers and the product. Impossible to steer and guide with a VC timebomb ticking that can only be defused by a 10–100x return. The most satisfying working relationships I’ve enjoyed in my close to two decades work in the internet business have been those that lasted the longest.

We have customers of Basecamp that have been paying us for more than 11 years! I’ve worked with Jason Fried for 14, and a growing group of Basecamp employees for close to a decade.

I keep seeing obituaries of this kind of longevity: The modern work place owes you nothing! All relationships are just fleeting and temporary. There’s prestige in jumping around as much as possible. And I think, really? I don’t recognize that, I don’t accept that, there’s no natural law making this inevitable.

I wanted the best odds I could possibly get at attaining the tipping point of financial stability. In the abstract, economic sense, a 30% chance of making $3M is as good as a 3% chance of making $30M is as good as a 0.3% chance at making $300M. But in the concrete sense, you generally have to make your pick: Which coupon is the one for you?

The strategies employed to pursue the 30% for $3M are often in direct opposition to the strategies needed for a 0.3% shot at making $300M. Shooting for the stars and landing on the moon is not how Monday morning turns out.

I wanted a life beyond work. Hobbies, family, and intellectual stimulation and pursuits beyond Hacker News, what the next-next-next JavaScript framework looks like, and how we can optimize our signup funnel.

I wanted to embrace the constraints of a roughly 40-hour work week and feel good about it once it was over. Not constantly thinking I owed someone more of my precious twenties and thirties. I only get those decades once, shit if I’m going to sell them to someone for a bigger buck a later day.

These motives, for me, meant rejecting the definition of success proposed by the San Franciscan economic model of Get Big or GTFO. For us, at Basecamp, it meant starting up Basecamp as a side business. Patiently waiting over a year until it could pay our modest salaries before going full time on the venture. It meant slowly growing an audience, rather than attempting to buy it, in order to have someone to sell to.

By prevailing startup mythology, that meant we probably weren’t even ever really a startup! There were no plans for world domination, complete capture of market and customers. Certainly, there were none of the traditional milestones to celebrate. No series A funding. No IPO plans. No acquisitions.

Our definition of winning didn’t even include establishing that hallowed sanctity of the natural monopoly! We didn’t win by eradicating the competition. By sabotaging their rides, poaching their employees, or spending the most money in the shortest amount of time… We prospered in an AND world, not an OR world. We could succeed AND others could succeed.

All this may sound soft, like we have a lack of aspiration. I like to call it modest. Realistic. Achievable. It’s a designed experience and a deliberate pursuit that recognizes the extremely diminishing returns of life, love, and meaning beyond a certain level of financial success. In fact, not only diminishing, but negative returns for a lot of people.

I’ve talked to more than my fair share of entrepreneurs who won according to the traditional measures of success in the standard startup rule book. And the more we talked, the more we all realized that the trappings of a blow-out success weren’t nearly as high up the Maslovian pyramid of priorities as these other, more ephemeral, harder-to-quantify motivational gauges.

I guess one way of putting what I’m trying to say is this: There’s a vast conspiracy in the world of startups! (Yes, get your tinfoil hats out because Kansas is about to go bye-bye). People act in their own best interest! Especially those whose primary contribution is the capital they put forth. They will rationalize that pursuit as “the good of the community” without a shred of irony or introspection. Not even the most cartoonish, evil tycoon will think of themselves as anything but “doing what’s best”.

And every now and again, this self-interest shows itself in surprisingly revealing ways. Like when you hear angels brag about how YOU CANNOT KNOW WHICH BUSINESS IS GOING TO BE THE NEXT UNICORN. Thus, the rational play is to play as much as you possibly can. I find that a stunning acceptance of their own limited input in the process. Hey, shit, I don’t know which mud is going to stick to the wall, so please, for the sake of my six-pack of Rolexes, keep throwing!!

This whole conference is utterly unrepresentative when it comes to the business world at large! That’s why the mindfuck is so complete. You have a tiny minority of capital providers, their hang-arounds, and the client companies all vested in perpetuating a myth that you need them! That going into the cold, unknown world of business without their money in your mattress is a fool’s errand.

Don’t listen! They’ve convinced the world that San Francisco is its primary hope for progress and that while you should emulate it where you can, that emulation is going to be a shallow one. Best you send your hungry and your not-so-poor to our shores so we can give them a real shot at glory and world domination.

They’ve trained the media like obedient puppies to celebrate their process and worship their vocabulary. Oh, Series A! Cap tables! Vesting cliffs!

But in the end, they’re money lenders.

Morality pitted against the compound leverage of capital is often outmatched. Greed is a powerful motivator in itself but it gets accelerated when you’re serving that of others. Privacy for sale? No problem! Treating contractors like a repugnant automatron class of secondary citizens to which the company needs not show allegiance? PAR FOR COURSE.

Disrupt-o-mania fits the goals of this cabal perfectly. It’s a license to kill. Run fast and break societies.

Not all evil, naturally, but sucking a completely disproportionate amount of attention and light from the startup universe.

The distortion is exacerbated by the fact that people building profitable companies outside the sphere of the VC dominion have little systemic need to tell their story. VCs, on the other hand, need the continuous PR campaign to meet their recruiting goals. They can’t just bag a single win and be content henceforth.

The presentation of unicorns is as real as the face of a model on a magazine cover. Retouched to the nth degree, ever so carefully arranged, labored over for hours.

The web is the greatest entrepreneurial platform ever invented. Lowest barriers of entry, greatest human reach ever. I love the web. Permission-less, grand reach, diversity of implementation. Don’t believe this imaginary wall of access of money. It isn’t there.

Examine and interrogate your motivations, reject the money if you dare, and startup something useful. A dent in the universe is plenty.

Curb your ambition.

Live happily ever after.

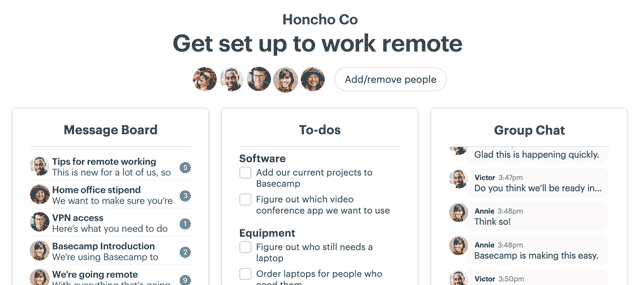

See what we’re up to at Basecamp after twelve years with the brand-new version 3 we just launched. Also, if you enjoyed RECONSIDER, you’ll probably like my books REWORK and REMOTE as well.

Amen to that!